The secret of ARM’s success lies in its

instruction set architecture, or ISA. Based on the concept of reduced

instruction set computing (RISC), ARM’s processors are significantly simpler

than the complex instruction set computing (CISC) products of its rivals. Where

a modern Intel processor may have between 700 million and 2.6 billion

transistors, ARM’s designs have a small fraction of that number. NVidia’s

dual-core Tegra 2 design, for example, has around 260 million transistors,

including those required for graphics processing and other tasks usually

carried out by discrete chips. Fewer transistors mean the chips are cheaper to

manufacture, take up less room in a system and draw less power - all key

features for the highly competitive mobile market.

“ARM isn’t happy with just its domination

of the mobile market, however”

For years, RISC processor designs struggled

to win market share against their CISC counterparts. The concept of a chip with

far simpler instructions that would execute faster was alien to many

programmers, who were used to the CISC way of doing things. It wasn’t until

mobile devices started to become popular that RISC would find a niche.

ARM isn’t happy with just its domination of

the mobile market, however. The company clearly remembers its origins on desks

up and down the country in the glory days of the microcomputer revolution, and

it won’t be satisfied until it’s back in its rightful place.

Dell

ARM server

Attacking The Data Center

A massively profitable area for Intel is

the data center, the buildings filled with servers that power modern life,

providing resources for everything from internet banking to online gaming.

Every major site you visit on the web is hosted in a data center, with larger

sites like Facebook having several dedicated buildings for this purpose.

Although Intel has some rivals in the data center market, including AMD, it

holds a majority share estimated at almost 95%, which is higher even than its

dominance in the laptop and desktop markets.

In short, it’s a market in which Intel

feels comfortable at least, until ARM started making waves.

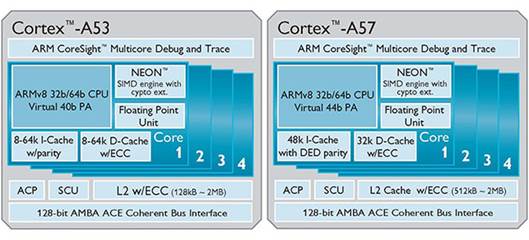

ARM’s latest design, the ARMv8-A

architecture, powers the company’s new Cortex-A50 family of processors. On the

surface, ARM is still looking towards the mobile market, but dig deeper and its

true intentions become clear: it’s taking on Intel in the data center.

The ARMv8 architecture adds a variety of

enhancements that make little sense in a mobile device but are

near-requirements in the data center. As with its predecessor, the ARMv7-A

architecture, ARMv8 includes cryptographic acceleration, hardware

virtualization extensions used by server-oriented platforms like VMware’s ESX,

and for the first time comes in a true 64-bit implementation.

AMD

Opteron

The latter is the most important: server

CPUs have used a 64-bit address space for years, allowing them to access large

quantities of memory and work on larger data chunks in a single cycle. Previous

ARM architectures have been exclusively 32-bit, with the ARMv7a Cortex-A15

adding support for ‘virtual addressing’ to access more than 4GB of memory for

the first time.

The ARMv8 architecture, the biggest

architecture change in the company’s history, is able to access several

terabytes (thousands of gigabytes) of memory. That’s a feature mobile phones,

which today come with a maximum of 2GB of memory, simply don’t need. Combined

with CoreLink, a fabric interconnects designed to allow hundreds of processor

cores to communicate efficiently, ARM finally has what it needs.

The jump to a 64-bit architecture means an

assault on the data center, and it’s a move that has Intel worried. With the

growth of cloud computing (servers that provide thousands of clients with

storage or processing), interest is rising in many-core, low-power servers, and

that’s a market Intel has been ignoring for far too long.

ARM Servers

There have been small-scale trials of

ARM-based servers in the past, with HP’s Project Moonshot originally aiming to

use ARM chips before choosing Intel’s Atom processors and Dell announcing the

Copper 48-core ARMv7 server product for limited roll-out earlier this year.

Efforts have been hampered by a lack of true 64-bit parts, however - an issue

that ARMv8 has now solved.

As a result, increasing numbers of

companies are coming forward to partner with ARM on server products. AMD, a

long-time rival of Intel’s, has recently announced that it will be launching

ARMv8-based server processors under its Opteron brand in 2014, following a

top-secret partnership with ARM formed last year. Rumours have even suggested

that graphics giant NVidia is considering adding ARMv8 cores to its Tesla

high-performance parallel processing platform to increase its flexibility.

Dell

ARM server

It’s not just hardware companies that are

looking into ARM, either. Clearly recognizing that software support is key,

several companies have announced projects to port common server applications to

the ARM architecture. The Linaro Enterprise Group, a non-profit organization,

has recently welcomed new members from Linux vendors Canonical and Red Hat

along with social networking giant Facebook, one of the biggest consumers of

data center hardware in the world, while other software companies including opens

USE have announced their own ARM porting efforts.

Software is key to a platform’s success.

Intel is struggling to convince companies to use its x86 architecture in

mobile, where software is optimized for the ARM architecture, and ARM is going

to have the same struggle getting its chips into the server market. With companies

like Red Hat, Canonical and Facebook onside, however, the problem is far from

insurmountable.

By 2015, it’s likely that numerous

off-the-shelf ARM-based servers will be available from a variety of companies,

with a software ecosystem that means they will be drop-in replacements for

x86-based servers in a large number of cases. These servers will appeal to the

cloud computing market, where the ability to run numerous low-complexity

processing threads simultaneously is valued far above the ability to run a

small number of high-complexity processing threads - something at which Intel

processors traditionally excel.

With ARM chips offering the potential for

greater density (the number of processing cores you can fit in a given space)

and significantly reduced power intake and heat output, rapid growth in the

server market is likely.

That’s a scenario which could prove bad

news for Intel.