New tools for small businesses

If you’re a small business that doesn’t

accept credit cards, you could be losing sales and customers. Cash-only

policies constrain customers, requiring them to purchase items costing no more

than the amount of cash they happen to have on hand, while checks limit sales

to the amount currently sitting in the customer’s bank account. Credit cards

offer your customers more flexibility, while helping you speed customers

through checkout, rather than having to count out change or wait while they

write out a check. Some consumers simply expect businesses to accept credit

cards; this can result in a loss of repeat business for businesses to accept

credit cards; this can result in a loss of repeat business for businesses that

aren’t credit card friendly. We’ll take a look at what’s involved in accepting

credit card payments.

You

may want to set up an Internet merchant account to authorize payments from your

website

Merchant account

The first step toward accepting credit card

payments will be visiting your local bank to apply for a merchant account. Once

that account has been established (a process that can take a few days), the

bank will take care of the actual transfer of funds. The commerce process works

like this: You’ll swipe the credit card (or manually enter the number), and the

bank will confirm the funds. Next, it will authorize the transaction and

exchange funds with the cardholder’s bank (e.g., MasterCard, Visa, American

Express). This should take a matter of seconds, at which point you can provide

the customer with a receipt. At some point shortly thereafter (often a couple

of days after the transaction), the bank will transfer the money to your

merchant account – less its processing fees, of course.

Visit

your local bank about available merchant accounts

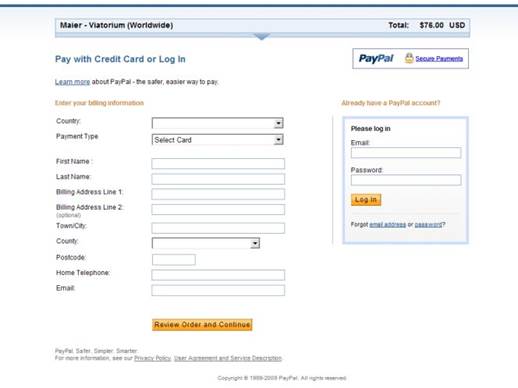

You may also want to apply for an Internet

merchant account, which allows you accept payments via an online shopping cart

on your website. Typically, Internet merchant accounts add security controls,

such as a payment gateway (likely an add-on feature provided by your Internet

service provider) and fraud protection. Some credit card providers also build

in technology that will authenticate the transaction online. Visa customers

will often see a Verified By Visa window pop-up after an online purchase, for

instance, while MasterCard users will see a MasterCard SecureCode window.

What equipment will you need?

There are several options for accepting

credit card payments. The most popular options are POS (point-of-sale)

terminals, which allow you to insert, swipe, or manually key in the credit card

info, from which the data will be automatically and securely sent along for

authorization. The manual key entry option is important, because your customer may

not always be present; instead, he or she may be phoning in an order or paying

through the mail. It’s also nice if the terminal can integrate with your

existing POS and inventory software. It’s also possible to use a standard

computer and virtual terminal software (typically provided by your merchant) to

process and verify transactions. For Internet transactions, you can also invest

in a PSP (payment service provider) or payment gateway that handles the

transaction information on your website. A PSP acts as a type of virtual

cashier, and typically, it’ll pro-vide your bank with all of the info necessary

to verify and transfer money.

Alternatives

At

your brick-and-mortar location, it’s convenient to use a POS terminal that

accepts credit card payments

It’s also possible go with a third-party

service, such as an independent sales organization, that partners with banks to

give you another way to accept credit cards. The third-party services are

popular, because banks often won’t approve credit card processing tools for new

businesses or for virtual businesses without a brick and mortar location. One

benefit of going with an independent sales organization is that you’ll likely

be able to accept multiple types of credit, because the third-party service

essentially works as a reseller. Be sure to compare your local bank options

with the fees and features provided by the third-party options.

There are also new services that let you

charge credit cards using your smartphone or tablet, and which provide small

card readers that plug into your device. There’s no complex fee structure, as

the mobile service will take a percentage-per-swipe or a flat monthly fee. The

fees are often more than you’d pay per transaction with a traditional merchant

account, but you won’t need to deal with banks, POS systems, contracts, and

monthly charges that can raise costs significantly for low-volume vendors.